Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you find yourself struggling with debt, you’re not alone. Millions of people face this challenge, but the good news is that there are effective debt management strategies that can help you regain control over your finances. Understanding these strategies can pave the way for a more stable financial future, allowing you to achieve your goals and enjoy peace of mind.

Debt management strategies encompass a variety of techniques designed to help individuals and businesses handle and reduce their debt. Essentially, these strategies provide a roadmap for navigating financial challenges, enabling you to minimize your debt load while improving your overall financial health. By implementing effective strategies, you can gradually work toward debt freedom and financial stability.

To effectively deal with debt, it’s crucial to understand the different types of debt management strategies available. Here are some valuable options to consider:

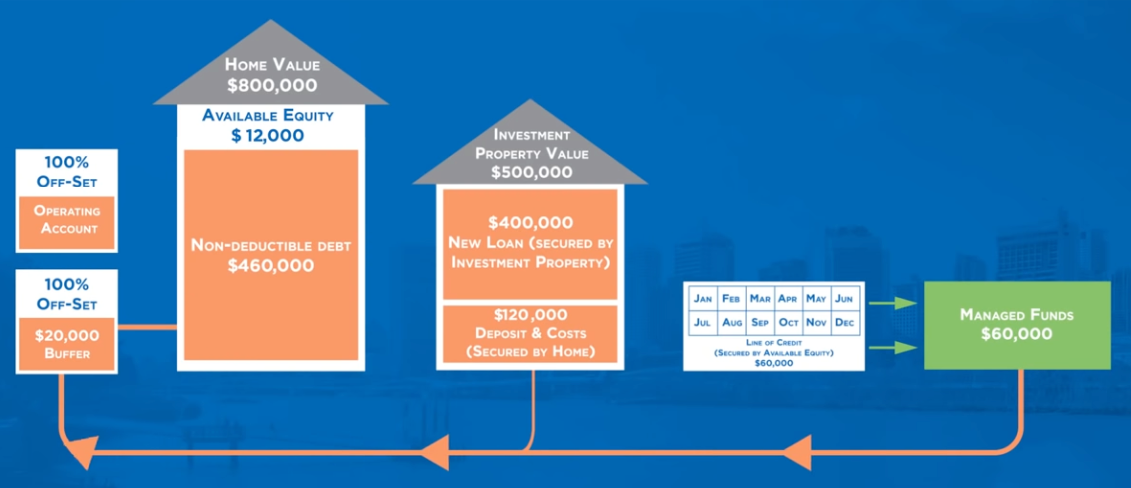

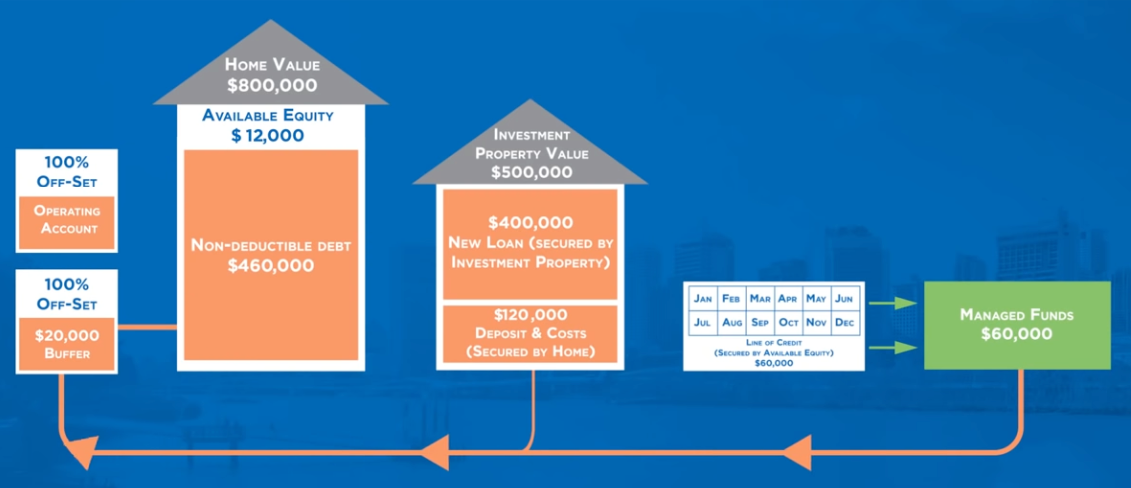

This visual representation illustrates various advanced debt management strategies and their interconnections. By comprehensively understanding how each strategy functions, you can make informed decisions that best suit your financial goals.

Implementing these strategies may seem daunting at first, but by breaking the process down into manageable steps, you will find it easier to approach your financial situation positively. Here are some actionable steps:

Debt management strategies can differ depending on your specific financial circumstances. Understanding this can lead to better-tailored approaches that resonate more with your unique needs. Here are some considerations based on different situations:

If you’re a recent graduate with student loans, you may want to explore income-driven repayment plans. These plans adjust your payments based on your income level, providing immediate relief as you embark on your career. Additionally, consider deferring payments temporarily to focus on finding stable employment while maintaining an eye on long-term repayment strategies as your income increases.

Homeowners facing mortgage-related debt may benefit from refinancing to secure lower interest rates. This reduces monthly payments, providing additional cash flow that can be redirected to other debts. Always weigh the costs of refinancing against potential savings to ensure it is a sound financial decision.

If credit card debt is weighing you down, look into balance transfers. Transferring existing card debts to one with a 0% introductory rate can provide initial relief, allowing you to focus on paying off the principal without accumulating additional interest.

Small business owners often face unique financial hurdles. Implementing debt management strategies tailored for business can lead to enhanced cash flow and long-term growth.

Effective cash flow management is essential for business viability. Maintaining detailed financial records helps predict cash flow fluctuations, enabling proactive planning. Prioritize timely invoicing, and follow up on overdue payments to maintain healthy cash flow.

Refinancing existing business loans can provide lower interest rates or better terms, helping ease monthly payment burdens. A professional financial advisor can assist in finding suitable refinancing options tailored to specific business needs.

Understanding and implementing effective debt management strategies is not just a method; it’s a mindset shift toward long-term financial wellness. Knowledge about various strategies enables you to make better financial decisions and educate others who may find themselves in hard financial situations. Through the lens of financial literacy, you empower yourself and potentially impact those around you positively.

Achieving financial stability requires commitment and determination. It’s crucial to remain engaged with your finances and adopt proactive measures to manage your debts effectively. By utilizing the beliefs explored throughout this article, you’re setting the foundation for a promising financial future.

Remember, you don’t have to navigate this journey alone. Engage with financial support systems, be they family, friends, or professional advisers, to maintain motivation and gain new strategies to confront financial challenges head-on. This community support can be invaluable during tough times, reminding you that regaining control of your finances is both possible and attainable.

The path to managing debt effectively is neither quick nor easy, but with the right strategies and a determined mindset, you will find yourself taking charge of your financial destiny. So, ask yourself, what are debt management strategies that resonate with you, and how can you put them into action today? Take the first step towards financial freedom now!