Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Investing in a bear market can be a daunting task for many individuals. With the market trending downwards, it is essential to adopt prudent strategies that can help mitigate losses while still positioning oneself for future gains. In this article, we will explore various tips for investing in a bear market and how to navigate these challenging financial waters carefully.

The first tip focuses on understanding the market dynamics during a bear phase. Make sure to stay informed about market trends and economic indicators that could affect your investments.

Defensive stocks are typically less sensitive to economic cycles. During a bear market, consider investing in sectors like utilities, healthcare, and consumer staples. These industries tend to have steady demand regardless of economic conditions, making them safer bets.

Before diving into any investment, assess your risk tolerance. Knowing how much risk you can comfortably handle will guide your investment decisions and help prevent emotional distress during turbulent times.

Having cash on hand provides you with the flexibility to make investments when opportunities arise. It can also offer a buffer during tough market conditions, allowing you to avoid panic selling.

Dollar-cost averaging is a strategy that involves consistently investing a fixed amount of money into a specific investment, regardless of its price. This method can lower the average cost per share in declining markets and minimize the impact of volatility.

Index funds can be a great way to diversify your investments without putting too much pressure on yourself. Many bear markets have proven to be temporal, and investing in index funds can help you ride out the downturn while still benefiting from the market’s recovery.

Regularly reviewing your investment portfolio is crucial, especially during a bear market. Evaluate each asset and assess whether adjustments need to be made based on current market performance or future outlook.

Dividend stocks provide a source of income even when share prices are falling. Look for well-established companies with a history of paying dividends, as they are more likely to weather economic downturns successfully.

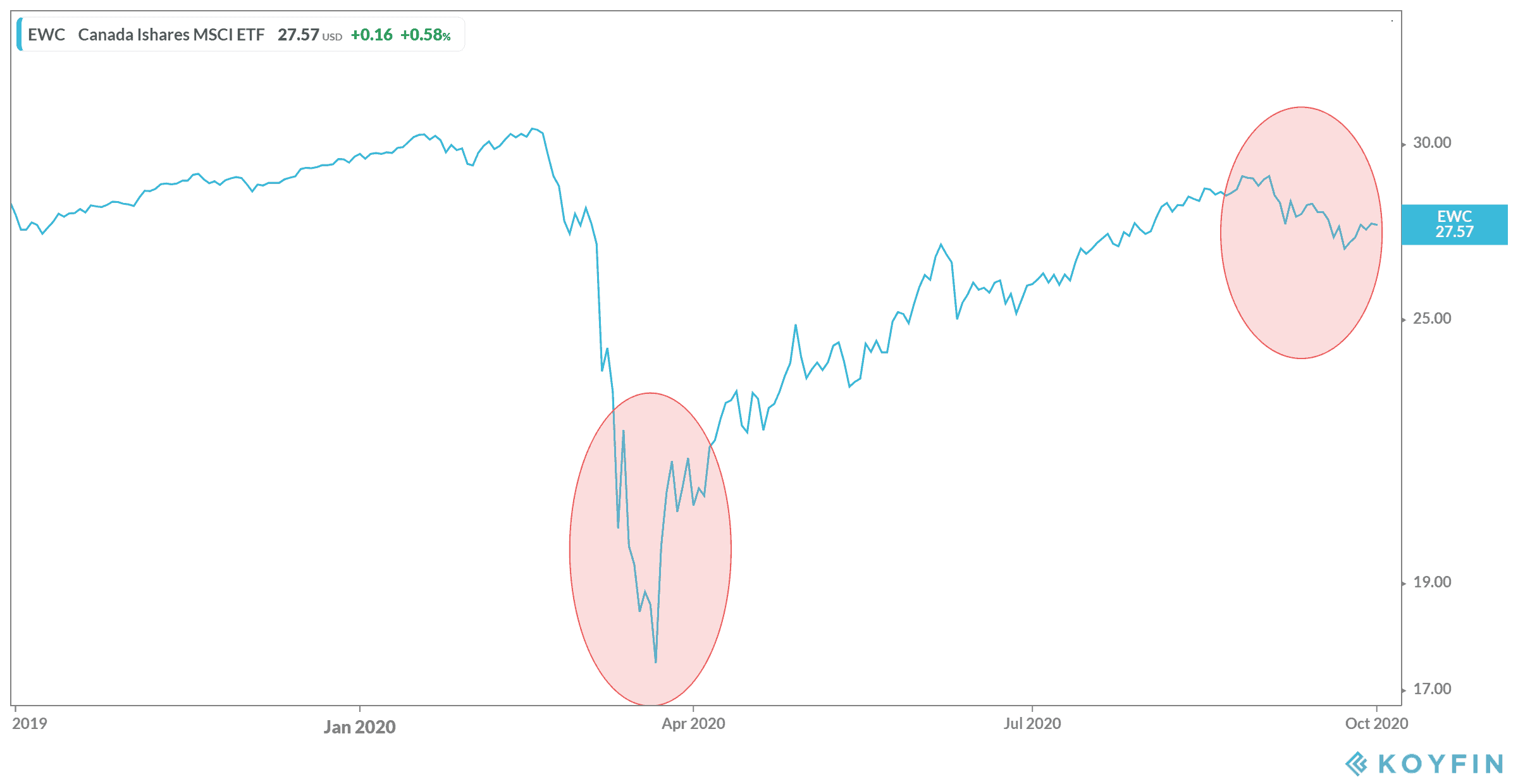

Bear markets can last for different durations, and understanding the cyclical nature of economies can help you better prepare and strategize your investments. Knowledge of historical movements can provide insights into potential future trends.

Patience is paramount when dealing with a bear market. Avoid the temptation to react impulsively to market fluctuations, and remember that staying invested is usually the best path to long-term growth.